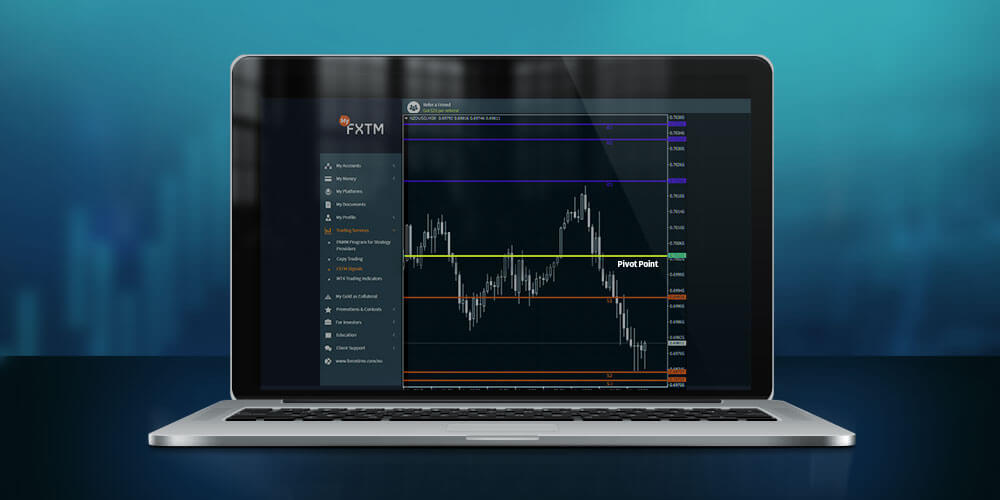

Understanding Pivot Points

Pivot points are extremely popular with traders, they are used to spot direction, probable reversal points and potential support and resistance levels. It’s a well-known tool that is of particular interest to novice traders, due to the simplicity of the mathematical formulas it incorporates.

In the past, pivot point calculations were used on daily, weekly and monthly timeframes. These days, new technology means we can calculate pivot points on smaller timeframes too.

Pivot points use the previous period’s open, close, high and low prices to calculate the current period’s direction and future support and resistance levels.

Formula

To identify possible turning points on current candlesticks, a pivot point calculation uses the formula below:

Resistance 3 = High + 2*(PP – Low)

Resistance 2 = PP + High – Low

Resistance 1 = 2*PP – LowPivot Point(PP) = (High + Low + Close) / 3

Support 1 = 2*PP – High

Support 2 = PP – (High – Low)

Support 3 = Low – 2*(High-PP)

After the main pivot point is calculated using the most recent candlestick’s typical price ((High + Low + Close) / 3), you can work out possible support and resistance levels.

The pivot point, in combination with the support and resistance levels, is an intraday trader’s ‘guide’ to the financial markets.

The concept states that, when prices float above the defined pivot point, the market is moving in a bullish direction and is likely to continue moving in an upwards direction, and vice versa. When the prices go below the pivot point, then the market is bearish and prices will probably move towards a downward direction.

Trading Pivot Points

Long positions opened above the pivot point can potentially meet resistance (R1-resistance level 1), which opens an opportunity for day-traders to lock in potential profits. A strong upwards surge above R1, could potentially open the path to more profit opportunities at higher resistance levels (R2 and R3). A protective stop-loss below the pivot point is recommended to avoid losses in case of unexpected volatility.

In the same way, short positions opened below the pivot point can potentially meet support (S1 – support level 1), opening the path for day traders to lock in potential profits. A strong downwards surge below S1 could can potentially lead to additional profit opportunities at lower support levels (S2 and S3). A protective stop-loss above the pivot point is recommended to avoid additional loses, in case of unexpected volatility.

Sideways movements are confined between the pivot point and R1, which are potential buying and selling opportunities for range traders, when prices bounce off the pivot point and rebound back from R1.

In case of a breakout above R1, prices could potentially be driven towards R2, and the pivot point will serve as support and vice versa. If a breakout below the pivot point occurs, then prices can potentially drop further towards S1 and the pivot point will act as resistance.

Additionally, if prices are under the pivot point they may meet support at S1 and bounce back up towards the pivot point.

When prices are confined between the pivot point and S1, also known as a range, potential trading opportunities can occur for buyers when prices bounce off S1 and for sellers when prices bounce back from the pivot point.

Techniques

In total, there are five pivot point techniques used for calculation – including the Standard technique which is the most popular.

1. Standard.

2. Fibonacci.

3. DeMark’s.

4. Woodie’s.

5. Camarilla.

All techniques, apart from the DeMark formula, use the previous period’s high, low and close prices to calculate the pivot point. The DeMark formula uses the relationship between the open and close price, to define one of the three formulas that will be used to calculate X in the appropriate pivot point calculation. In addition, Camarilla uses the current period’s open price in the pivot point calculation.

Pivot point calculation techniques vary in terms of the weight assigned to each pivot point level. These are pivot point, support and resistance, and the distance between each pivot point.

Conclusion

The reason pivot points are still some of the most valuable tools in forex trading is because they provide a simple way of understanding which direction the market is heading in.

Markets are bullish when prices are above the pivot point and bearish when prices are below.

This tool allows the trader to easily calculate potential support and resistance levels, where prices may halt before continuing to trade sideways, or break above or below a range depending on the supply or demand.

However, just like with any technical analysis tool, in order to give your trading strategy the best potential, pivot points should be combined with other indicators/oscillators and candlestick reversal patterns for extra confirmation.

Put your knowledge into practice with our demo forex trading account.

Return to Articles Ebooks Glossary Videos

Disclaimer: This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: There is a high level of risk involved with trading leveraged products such as forex and CFDs. You should not risk more than you can afford to lose, it is possible that you may lose more than your initial investment. You should not trade unless you fully understand the true extent of your exposure to the risk of loss. When trading, you must always take into consideration your level of experience. If the risks involved seem unclear to you, please seek independent financial advice.