Daily Market Analysis and Forex News

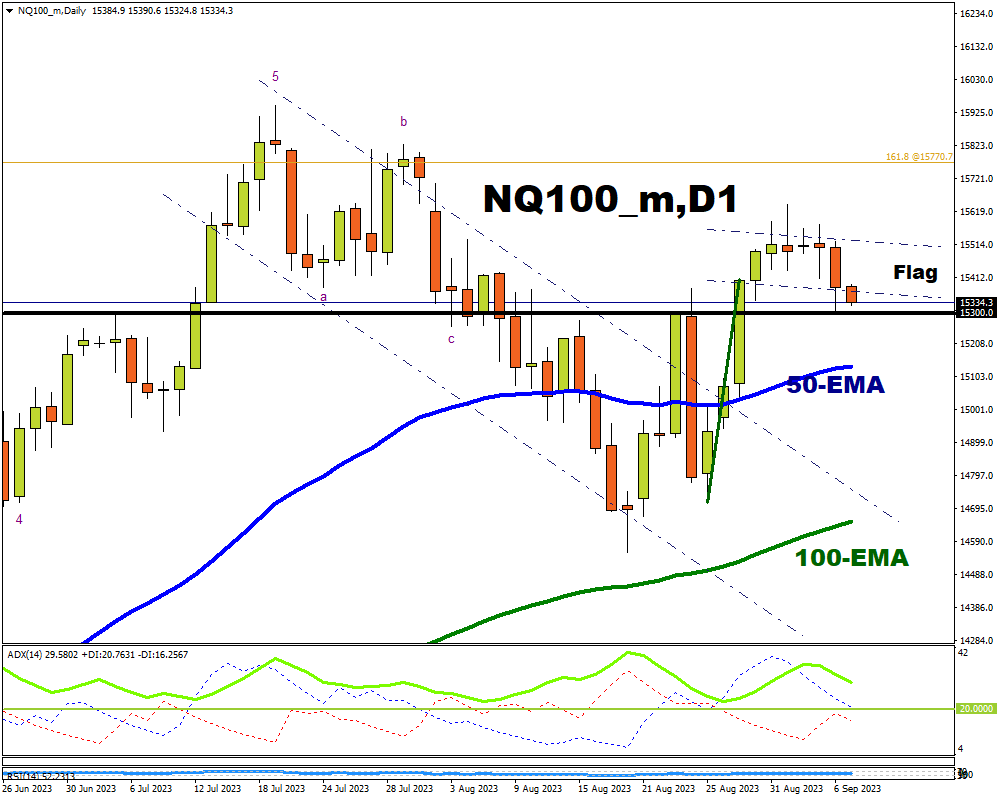

NQ100_m bullish flag in play above key support

The last six days have been a choppy affair for the NQ100_m with prices trading in a downward-sloping range on the daily charts. However, we see a bullish flag formation in play after the initial rally from August 25th.

A bullish flag is a bullish continuation pattern.

This will continue to hold true if prices do not close below the support zone of the flag pattern.

The price action witnessed on September 6th saw the NQ100_m retreat from the flag’s resistance on the daily timeframe. Prices later broke through the flag's support to bounce off the psychologically important price level of 15300 and close right back within the flag pattern.

If we see a major rout in the tech stocks amid revived concerns over the Federal Reserve keeping interest rates higher for longer, then bears may be looking for a close outside of the flag and a strong close below the key 15300 price level for any signs of a continuous decline towards its 50-EMA.

Bulls on the other hand will be licking their chops over a move to the flag’s resistance in the short term, and a possible 6805 points move (the distance of the flag’s pole) if the price closes above the flag’s resistance.

A rally, however, will see price contend with the 161.8 Fibonacci price level at 15770.7.

The Fibonacci here is drawn from the August 14th, 2022’s high of 13730.1 to October 9th, 2022’s low of 10437.8 on a weekly timeframe.

Ready to trade with real money?

Open accountChoose your account

Start trading with a leading broker that gives you more.