Daily Market Analysis and Forex News

Technical Outlook: Yen Crosses Under The Spotlight

Our currency spotlight shines on the Japanese Yen which has weakened against most G10 currencies this week.

The weakness could be based on a jump in risk sentiment amid strong corporate earnings. However, geopolitical tensions and inflation worries could still accelerate the flight to safety, rekindling appetite for safe-haven assets like the Yen.

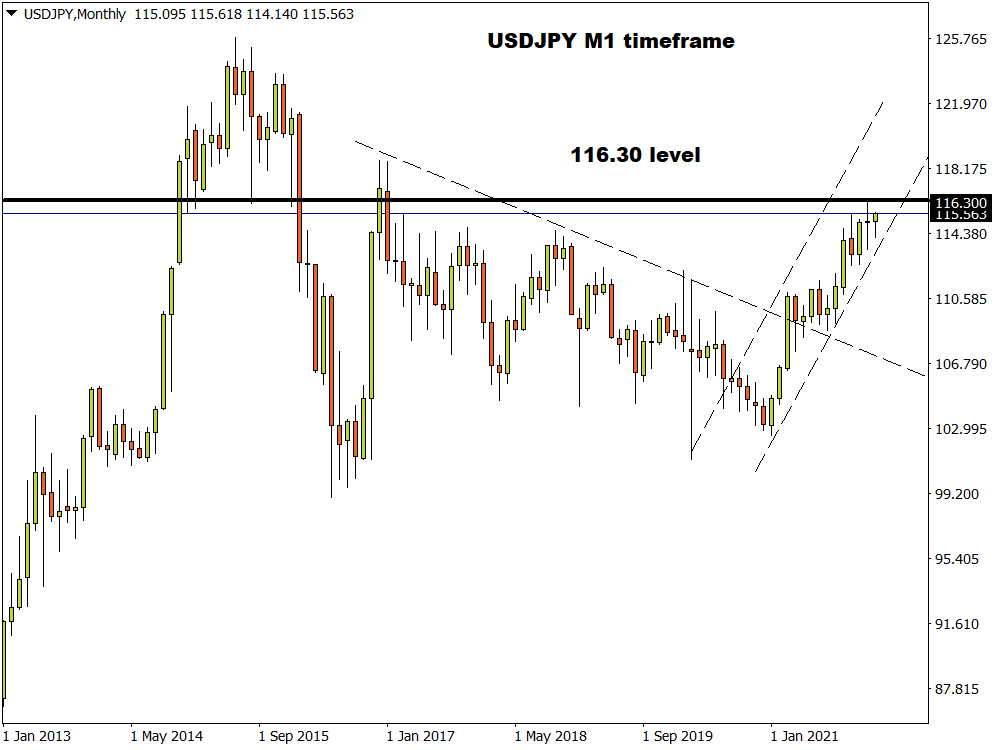

Focusing on the technicals, February could be a volatile month for the Yen if conflicting themes influence global risk sentiment. Looking at the USDJPY, prices remain firmly bullish on the monthly timeframe as there have been consistently higher highs and higher lows. Bulls remain in a position of power but need to conquer 116.30 to open the doors to further upside.

The story changes on the weekly charts. Prices remain in a wide range with support around 113.360 and resistance at 115.50. A solid weekly close above this resistance could trigger an incline towards 116.30 and 117.40. Alternatively, a rejection from 115.50 could inspire a selloff towards 114.50, 114.00, and 113.360.

Some momentum is building on the daily charts with bulls in a position of power. A strong daily close above 115.50 could trigger a move towards 116.00 and 116.30.

EURJPY bulls in the building

The aggressive rally last Thursday may have set the tone for the EURJPY this month.

A hawkish ECB tipped the balance between the EUR and JPY with bulls going out of control. Prices are trading around the 132.00 level of writing with further upside certainly on the cards. A strong daily close above 131.70 could encourage a move towards 132.60 and 133.47. Technical indicators such as the Simple Moving Average and MACD agree with the bullish outlook. Should 131.70 prove to be unreliable support, a decline back towards 131.00 and 130.20 could become reality.

GBPJPY journeys north after bounce on MAs

The GBPJPY remains in a healthy bullish trend on the daily charts after bouncing from the 50,100 and 200 Simple Moving Averages. A weaker Yen may inject GBPJPY bulls with enough confidence to challenge the 157.50 resistance level. Should prices secure a daily close above this point, the next key point of interest will be found around 158.19. Alternatively, if 157.50 proves to be a tough nut to crack, prices are likely to decline back towards the 155.50 support.

AUDJPY presses against 82.50

A major breakout could be on the horizon for the AUDJPY. Prices are trading just below the 82.50 level which is where the 50, 100, and 200 Simple Moving Average reside. A solid breakout and daily close above this point could open a path towards 84.00. Should 82.50 prove to be reliable resistance, prices may decline back towards 80.50.

Ready to trade with real money?

Open accountChoose your account

Start trading with a leading broker that gives you more.