Daily Market Analysis and Forex News

Trade of the Week: Gold hovers near $2k ahead of Powell

- Gold kicks off Monday on shaky note amid risk-on mood

-

Fed speeches + Powell may influence precious metal

-

Gold bullish but RSI overbought on daily charts

-

Key levels of interest at $1968, $2000 and $2010

Gold prices have kicked off the new week on a wobbly note despite punching above the psychological $2000 level last Friday.

The precious metal jumped almost $15 within minutes after the US jobs report printed weaker than expected last week. With the US economy adding 150,000 jobs in October compared to the 180,000 forecast, and previous months numbers revised lower – bets jumped around the Fed not raising rates further.

While rising hopes around no more Fed hikes is good news for zero-yielding gold, this has also boosted overall risk sentiment – capping upside gains as investors shop for riskier assets.

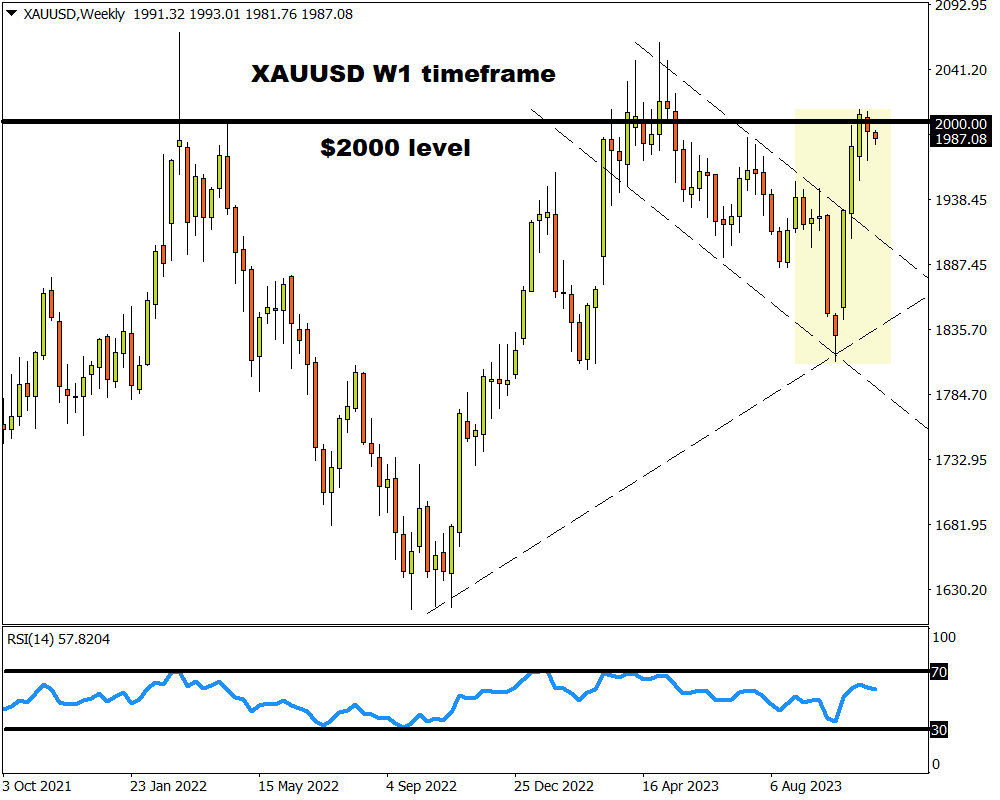

Nevertheless, gold is still up more than 8% since the Hamas attacks on Israel with prices hovering near the psychological $2000 level. Taking a quick look at the technical picture, prices are bullish on the weekly charts but the Relative Strength Index (RSI) is slowly approaching overbought conditions.

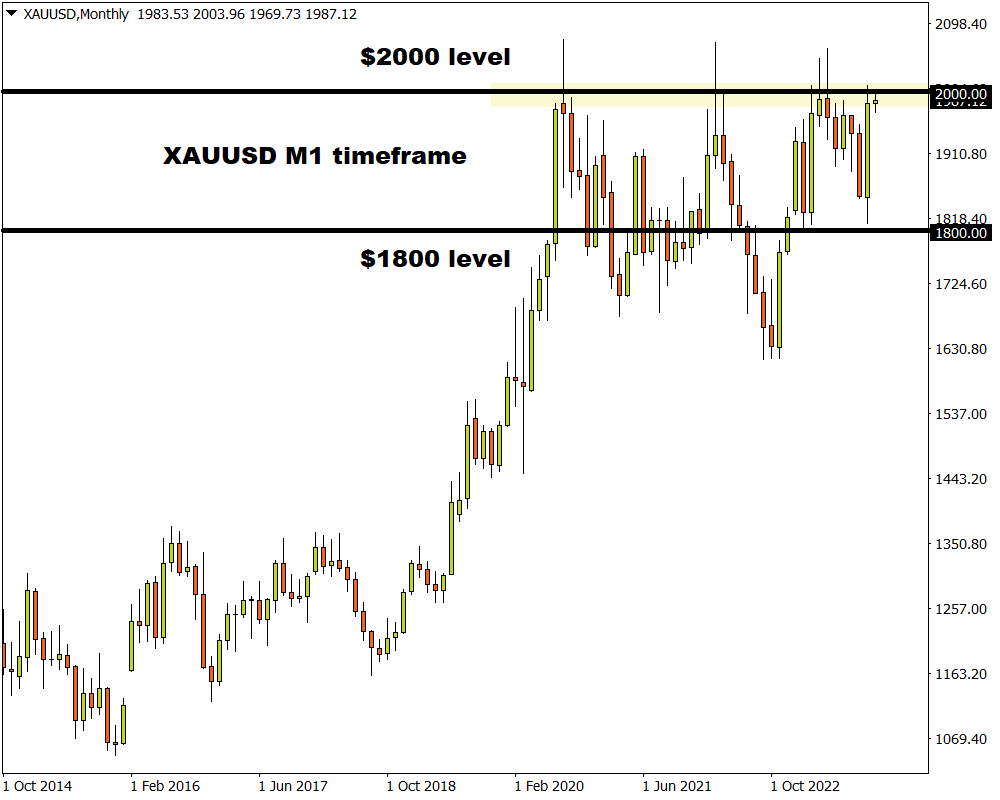

Zooming out on the monthly chart, prices remain in a very wide range with key resistance at $2000 and support at $1800.

Fun fact: Gold has never secured a monthly close above the psychological $2000 level.

Although this is a much quieter week on the risk calendar, some events could impact gold over the next few days:

-

Fed speeches + Powell

The week is jampacked with speeches from numerous Fed speakers, including Chair Jerome Powell on Thursday.

Investors will be looking for fresh clues on the Fed’s interest rate path, especially when considering how the central bank has not fully ruled out future hikes. While Powell has dropped hints about the Fed done with hikes, he has also warned that there was still much work to be done on inflation.

After last Friday’s jobs report, the probability of a Fed rate hike in December stands at only 10%. Interestingly, traders have fully priced in a rate cut by June 2024.

- Gold prices may edge higher if Powell and Co. adopt a dovish tone and hint that the Fed is done with hikes. However, gains could be capped if these remarks support risk sentiment.

- Any unexpected hawkish cues from Fed speeches that spark a rebound in dollar and Treasury yields may drag gold prices away from the psychological $2000 level.

-

Geopolitical risks

Ongoing tensions in the Middle East remain a major element of uncertainty for global markets.

Should fears intensify over a potential spillover from the Israel-Hamas conflict, this could spark a fresh wave of risk aversion, sending investors towards safe-haven destinations like gold. It’s not only the developments in the Middle East but also Russia’s invasion of Ukraine that could fan fears about a global recession. Although the focus seems to have shifted back towards interest rates, geopolitics may play a role in shaping gold’s outlook.

- Should tensions in the Middle East hit risk sentiment, this could provide room for gold to push higher.

- Any fresh signs of easing geopolitical tensions could boost overall risk sentiment, dragging gold lower as a result.

-

Technical forces: breakout?

There seems to be a fierce tug of war around the $2000 level as bulls and bears fight for control.

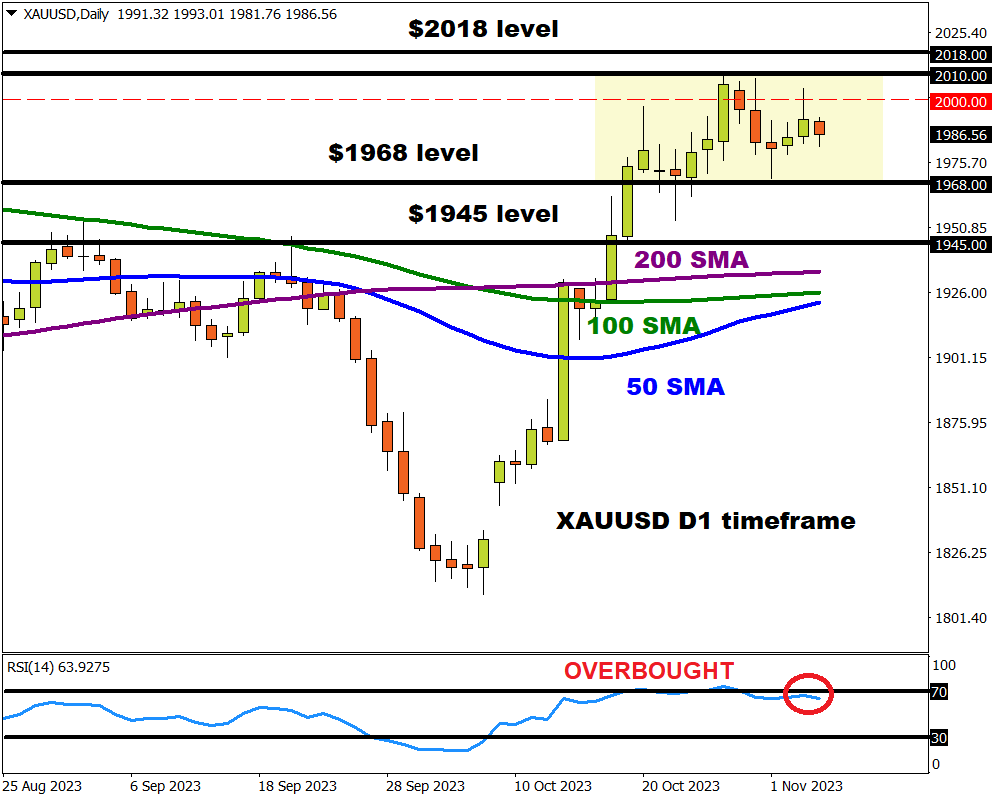

The scales of power swing in favour of bulls on the daily charts with technical indicators signalling further upside. Prices are above the 50, 100, and 200-day SMA while the MACD is trading above zero. However, the Relative Strength Index (RSI) signals that prices are overbought on the daily timeframe. Key support can be found around $1968 with resistance at $2010 but the pivotal level remains at $2000.

- A strong daily close above $2000 may provide the foundation for bulls to target $2010 and $2018, respectively.

- Should prices remain capped below $2000, this could trigger a decline back towards $1968 and $1945.

Currently, Bloomberg’s FX model points to a 76% chance that Gold will trade within the $1956.63 - $2024.73 range this week.

Ready to trade with real money?

Open accountChoose your account

Start trading with a leading broker that gives you more.